MULTI-PERIOD LOAN INTEREST RATE NASH MODEL WITH BASEL II SOLVENCY CONSTRAINT – тема научной статьи по математике читайте бесплатно текст научно-исследовательской работы в электронной библиотеке КиберЛенинка

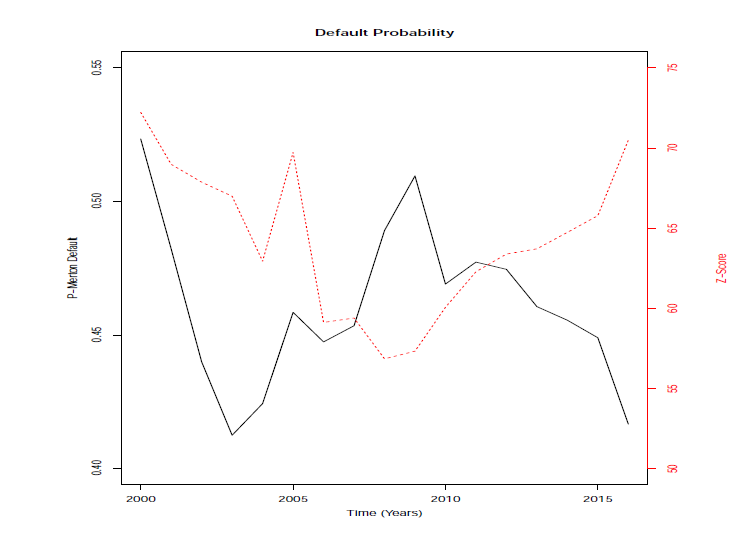

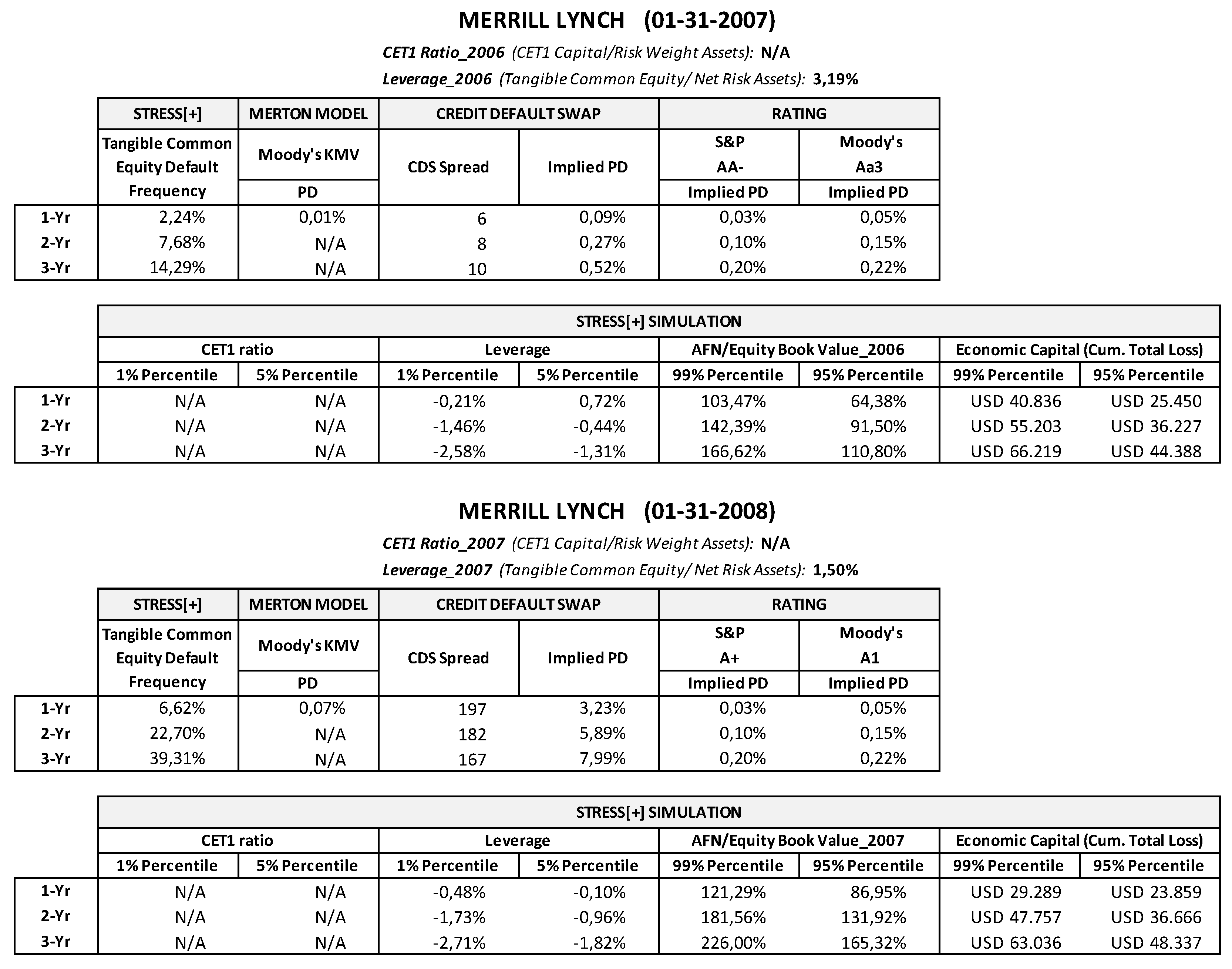

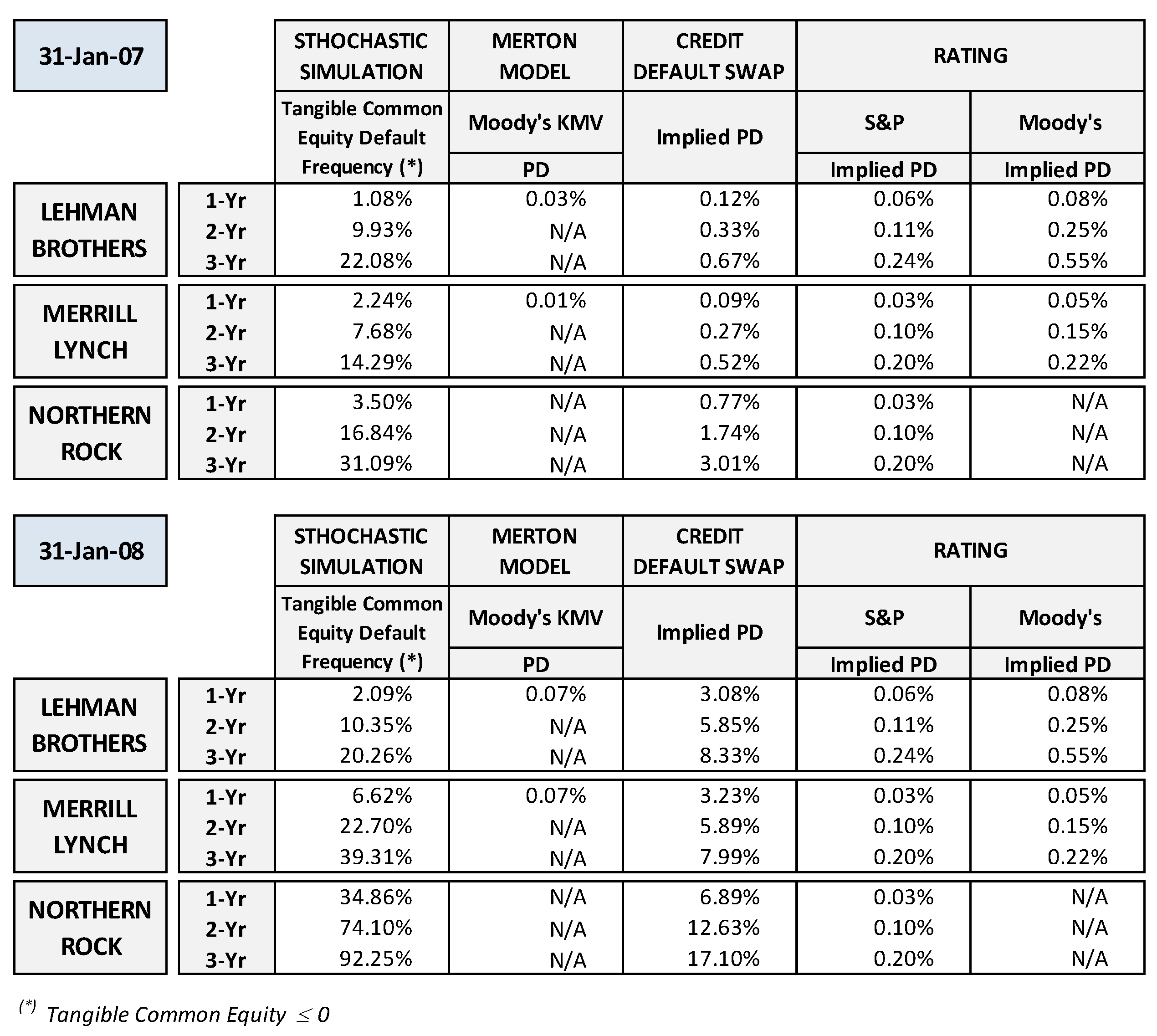

Risks | Free Full-Text | Bank Stress Testing: A Stochastic Simulation Framework to Assess Banks' Financial Fragility †

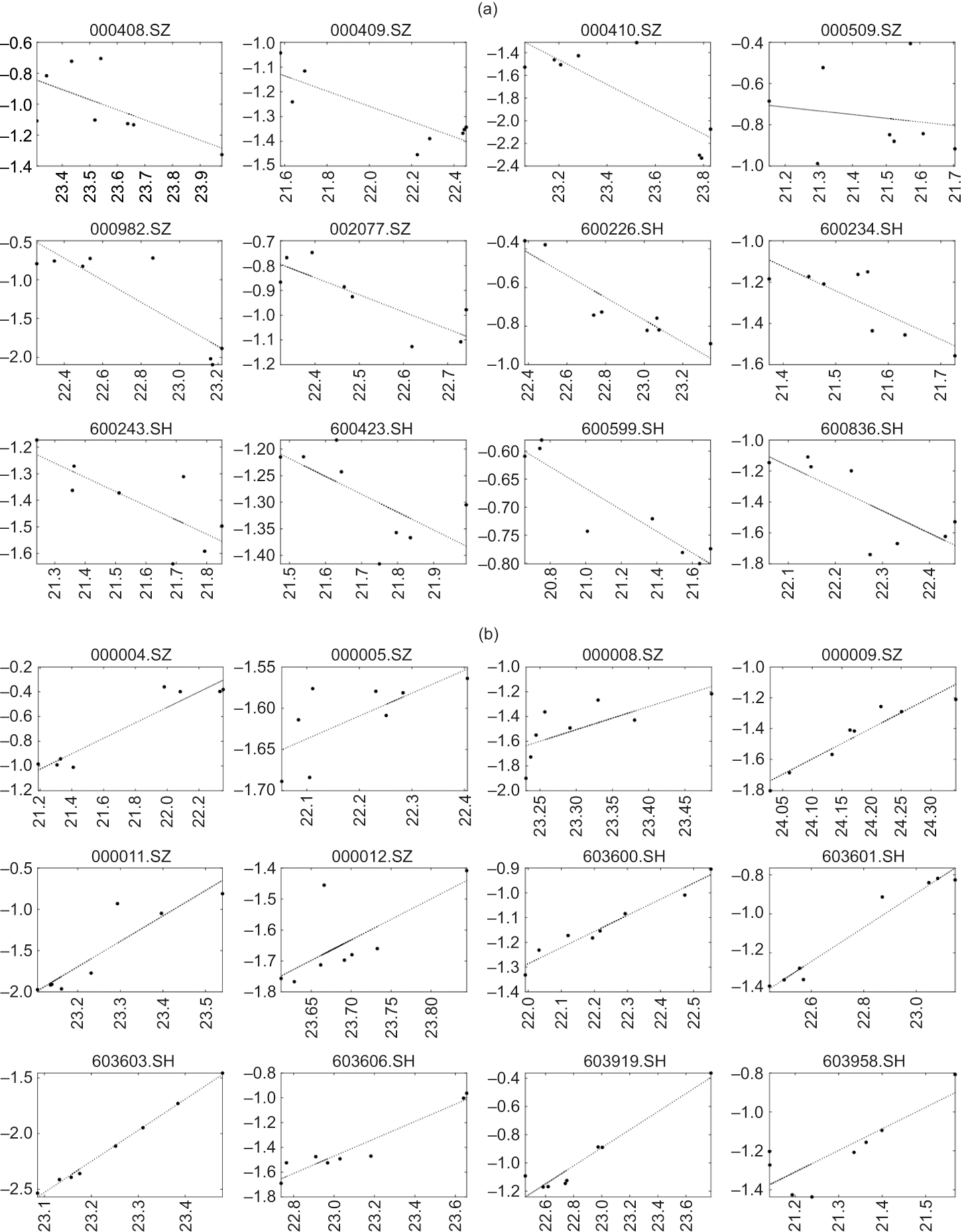

Redefinition of the KMV model's optimal default point based on genetic algorithms – Evidence from Taiwan - ScienceDirect

Risks | Free Full-Text | Bank Stress Testing: A Stochastic Simulation Framework to Assess Banks' Financial Fragility †

Expected Default Frequency Model (EDF)Model/KMV Model/ Credit risk/ Credit strength /ICFAI /MAKAUT - YouTube