Mathematics | Free Full-Text | Interactions of Logistic Distribution to Credit Valuation Adjustment: A Study on the Associated Expected Exposure and the Conditional Value at Risk

PDF) Algorithms for handling CVaR-constraints in dynamic stochastic programming models with applications to finance

PDF) Enhanced Index Tracking with CVaR-Based Measures | Włodzimierz Ogryczak, Gianfranco Guastaroba, and M.Grazia Speranza - Academia.edu

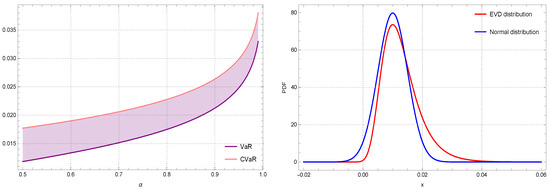

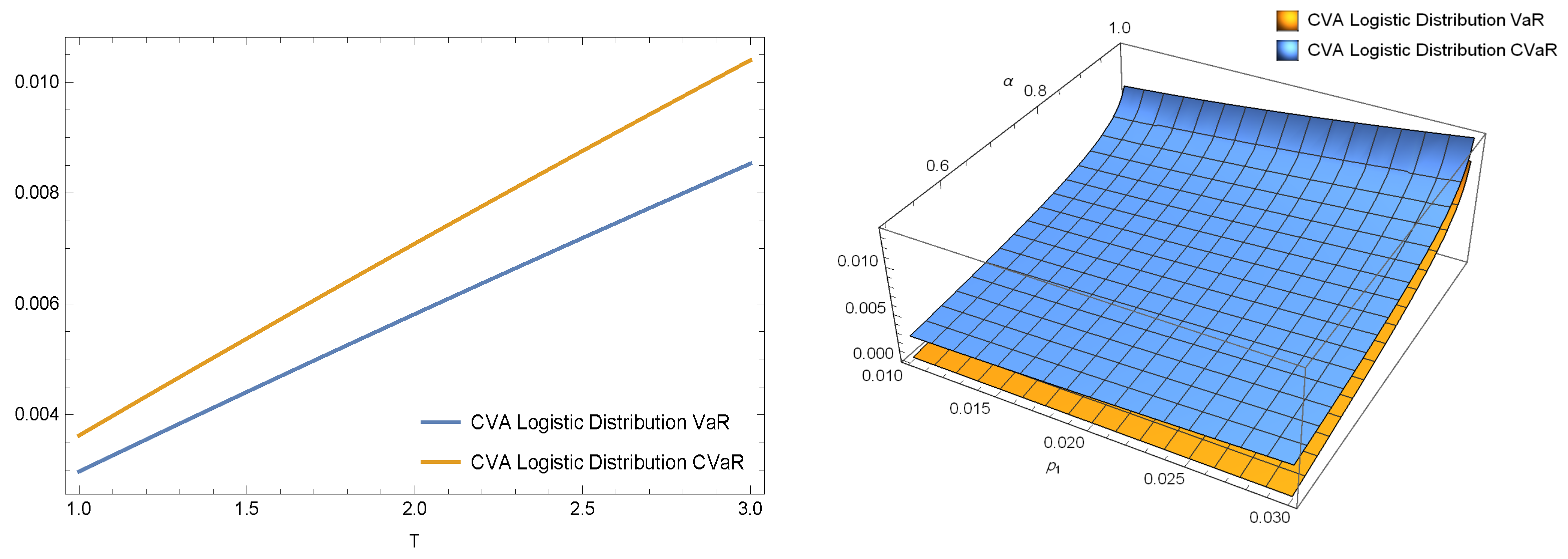

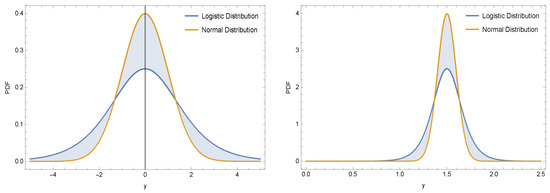

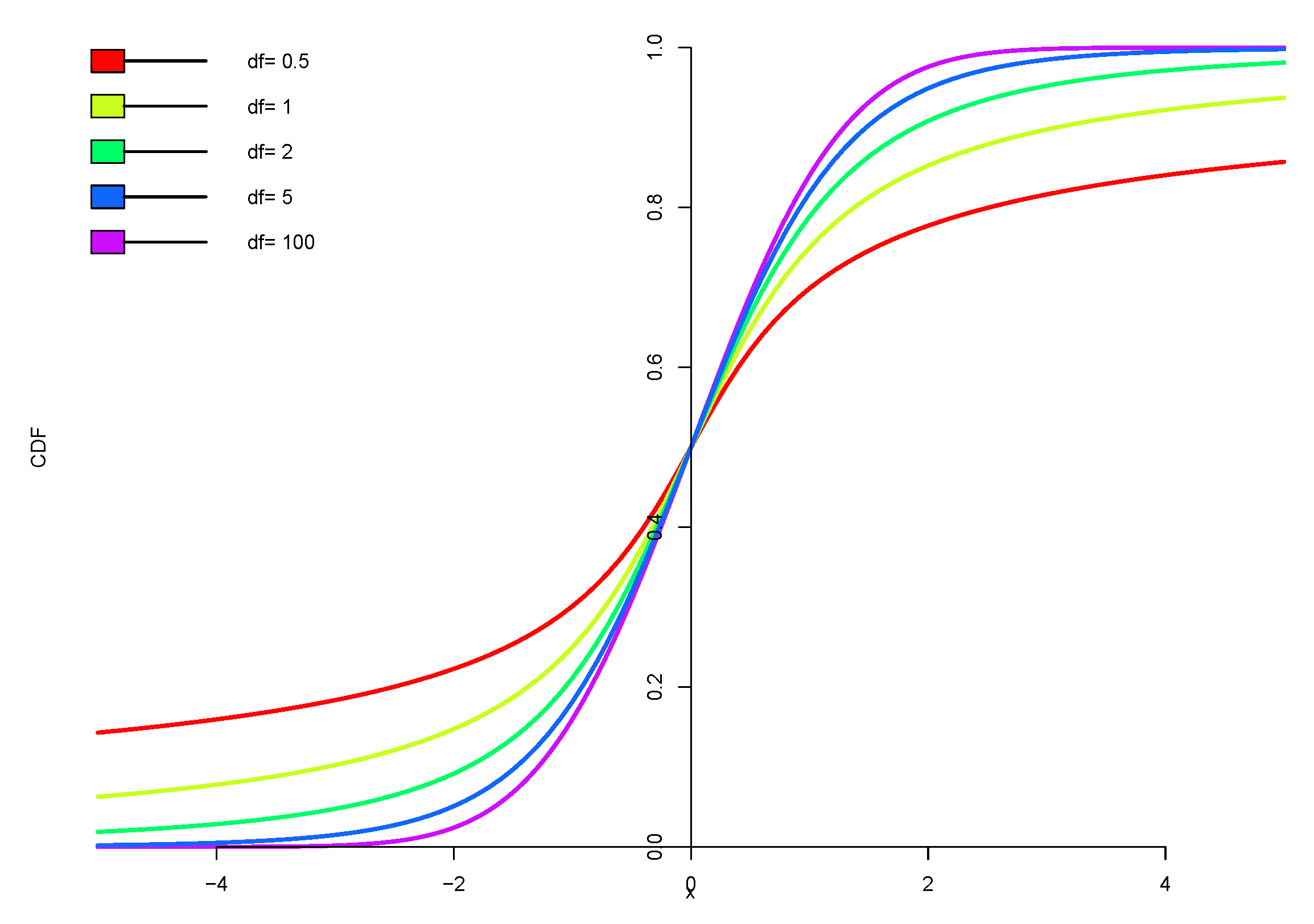

Mathematics | Free Full-Text | Interactions of Logistic Distribution to Credit Valuation Adjustment: A Study on the Associated Expected Exposure and the Conditional Value at Risk

Mathematics | Free Full-Text | Dominance-Based Decision Rules for Pension Fund Selection under Different Distributional Assumptions